The Dynamics of Money Market Funds amid Economic Uncertainty

In the ever-fluctuating landscape of finance, money market funds (MMFs) have emerged as a beacon for risk-averse investors. The current climate, characterized by uncertainty induced by elections, Federal Reserve (Fed) monetary policy, and other macroeconomic factors, has led to unprecedented inflows into both taxable and tax-exempt MMFs. Recent statistics reveal that these funds have reached significant highs in 2024, reflecting a defensive posture taken by market participants as they navigate a volatile environment. This article aims to dissect the intricate dynamics surrounding money market funds, focusing on the implications of financial stability, interest rates, and investor behavior.

The prevailing investor sentiment has seen a marked shift towards caution and risk aversion. According to Kim Olsan, a senior fixed income portfolio manager at NewSquare Capital, the anticipation of the Fed’s first rate cut after a nine-month wait has significantly influenced market behavior. This cautious approach is underscored by the allure of higher short-term interest rates, which have rendered MMFs and short-dated bonds particularly appealing. The Money Fund Report indicates a robust inflow of $3.2 billion into tax-exempt money market funds during the latest reporting week, bringing total assets in these funds to an impressive $136.84 billion—an evident response to current interest rate dynamics.

What is pivotal to understanding this transition is the backdrop of the COVID-19 pandemic, which caused a seismic shift in the financial landscape. Prior to the onset of the pandemic, the aggregate of tax-exempt and taxable MMFs was between $2 trillion and $3 trillion. However, the turmoil triggered by the pandemic led to an overwhelming influx of cash into these funds, a situation only exacerbated by subsequent Fed interest rate hikes. Today’s overall investments in MMFs have surpassed $6.585 billion, showcasing their appeal as a safe harbor during uncertain times.

An important marker in the current financial climate is the inversion of yield curves observed in recent months. Olsan draws attention to this phenomenon—where money market rates exceed the yields of longer-term bonds—pointing to an inversion of approximately 50 basis points between short-term MMFs and 10-year Treasury yields. This inverted yield curve is critical as it shapes investment strategies. Investors, particularly those in higher tax brackets, may favor municipal products as fiscal pressure increases.

Moreover, the gradual rise in muni money fund balances—reportedly 5% higher than through the third quarter—further accentuates this trend. The prevailing market conditions may encourage investors to maintain their allocations in MMFs for a longer duration, particularly as the Fed’s actions on interest rates unfold. The ongoing debate among analysts suggests that sustained sensitivity to these rate changes will dictate the flow and allocation of these assets.

Despite the apparent stability that MMFs offer, volatility continues to loom large. Rick White, an independent consultant, highlights the inherent unpredictability of market dynamics—where inflows and outflows can lead to rapid changes in daily rates within funds. For instance, the movement of capital at the start of November saw substantial liquidity move into daily positions, with subsequent rapid depletion of those assets. Such fluctuations make it essential for investors to remain agile and responsive to evolving market conditions.

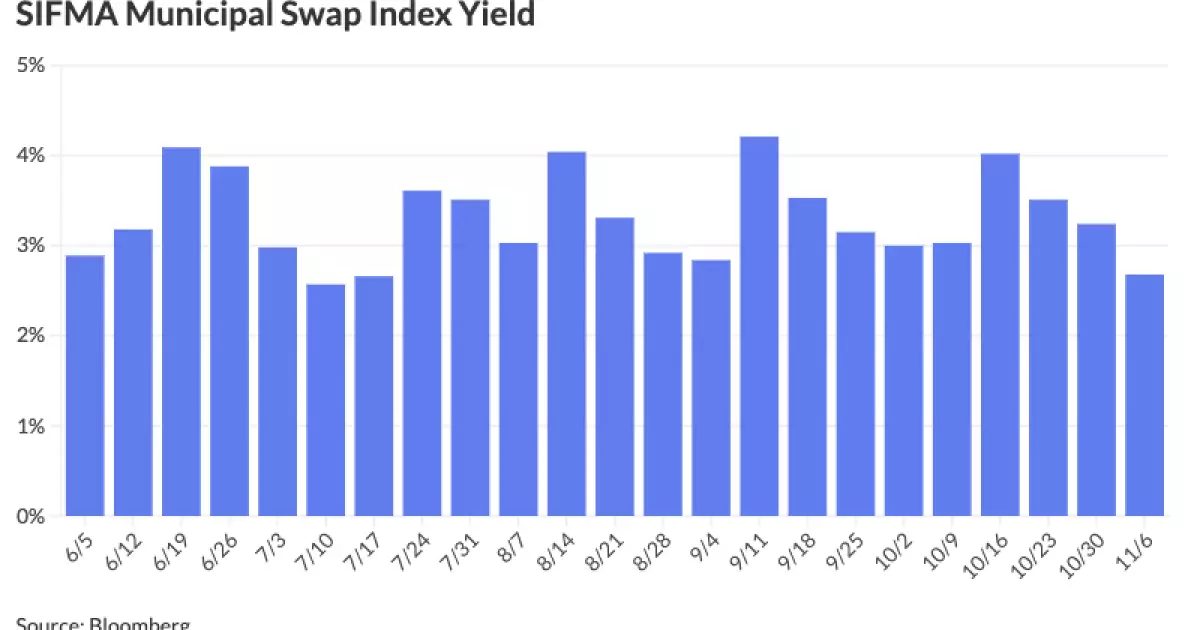

The SIFMA Swap Index, a key benchmark for interest rates, exemplifies these fluctuations, having dropped from 3.24% to 2.68% within a week. White emphasizes that the increasing assets in combination with the index trending below the average point towards potential stability—a welcome sign after extreme rate volatility that has plagued the market for years.

Looking forward, the trajectory of funds flowing into or out of MMFs will largely depend on the speed and manner of the Fed’s rate adjustments. Golden posits that unexpected outflows occurred when the Fed announced rate cuts, surprising many investors who had initially expected economic resilience. Going forward, it is crucial to understand that not all capital will recommit to equities or bonds; rather, a diverse range of asset classes will likely emerge as spillover zones for the trapped liquidity in MMFs.

For tax-exempt MMFs, these funds continue to represent a small fraction of the taxable market, and as such, any significant variations in investor behavior post-election remain uncertain. The possibility of substantial inflows transitioning from MMFs into long-term assets hinges on observable market movements, particularly concerning U.S. Treasury yields.

As the financial environment continues to evolve, the resilience and adaptability of money market funds will play an essential role in shaping the actions of cautious investors. Continued observation of monetary policy changes and economic signals will be paramount for navigating this intricate landscape.