The Resurgence of Solar Stocks: A Beacon Amid Market Turmoil

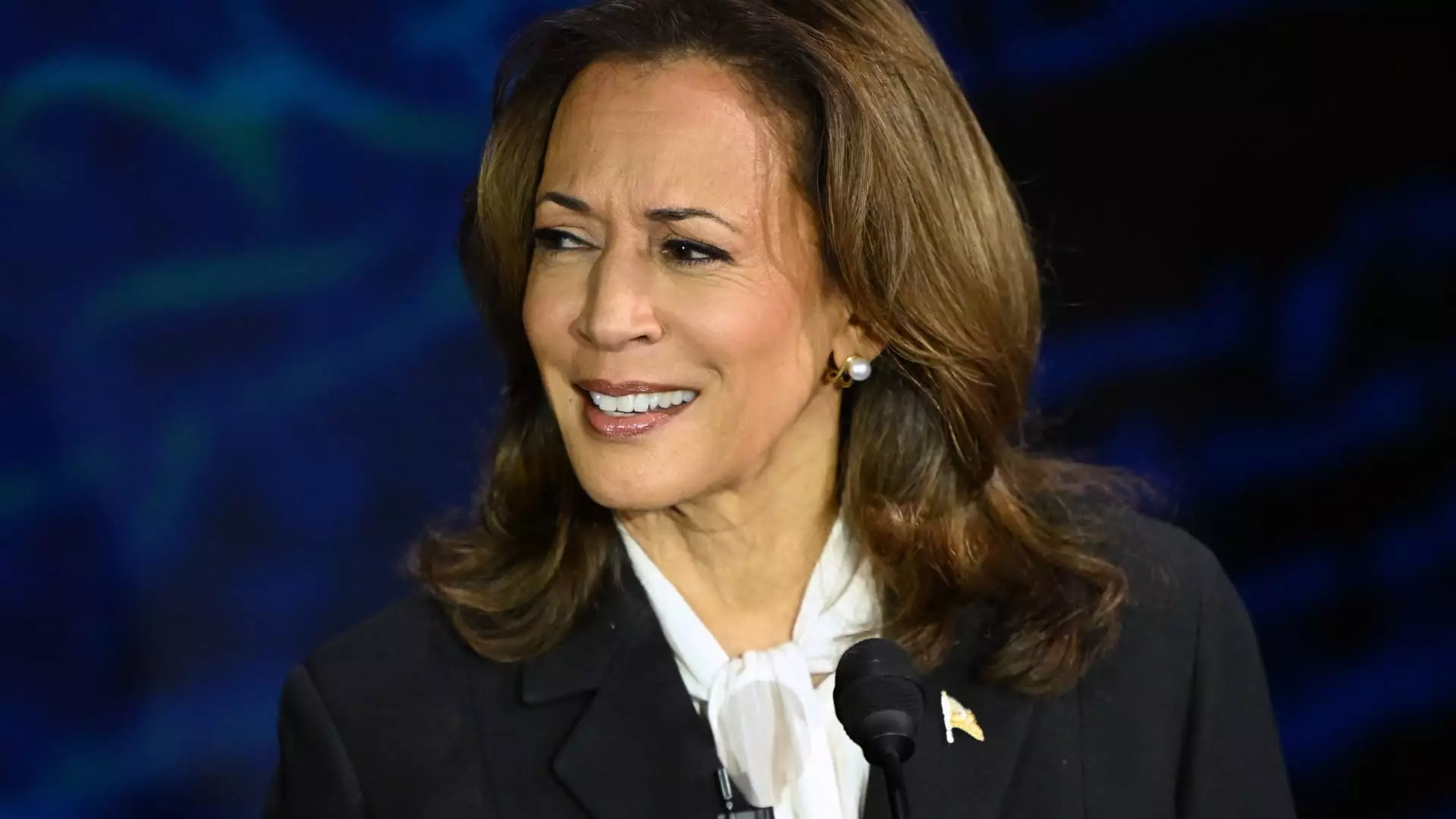

The recent sell-off in equity markets, triggered by disappointing inflation metrics, has left many investors apprehensive about future prospects. However, amidst this tumult, solar stocks have emerged as an unlikely contender for gains, defying the general trend. The catalyst for this unexpected upturn appears to be the outcome of the latest presidential debate, where Vice President Kamala Harris’s performance has reignited hopes for a robust clean energy agenda in the upcoming election. This development has energized investors, contributing to an optical shift in sentiment towards renewable energy.

The broader market witnessed the Invesco Solar ETF (TAN) declining over 25% year-to-date, overshadowing the S&P 500’s modest increase of 14% and the Nasdaq 100’s 11% gain. This disparity raises critical questions regarding the future trajectory of solar stocks, specifically in light of changing political landscapes and societal emphasis on sustainability.

Within the solar sector, First Solar Inc. (FSLR) and Sunrun Inc. (RUN) stand out as two of the strongest performers, each reflecting unique technical setups that merit analysis. For FSLR, the stock initially enjoyed a meteoric rise, outperforming its indices and soaring to just over $300 by mid-June. However, a rapid descent followed, stabilizing FSLR around a crucial support level of $210, and it has since fluctuated within a trading range of $200 to $240.

This consolidation phase is indicative of typical investor behavior, where periods of indecision give way to notable price movements. Historically, resistance levels have been pivotal, and a powerful breakout above $240 could signal a bullish retracement towards previous highs around $300, drawing renewed interest from cautious investors.

In contrast, Sunrun’s trajectory presents a more favorable technical profile. After encountering solid support in the $9 range late last year and reaffirming that level in early 2024, RUN has developed a promising sequence of higher highs and higher lows. This pattern indicates a firm uptrend, suggesting that strategic entry points may emerge during minor pullbacks, particularly near the 50-day moving average.

Despite the favorable technical setups, investors should remain vigilant about potential hurdles. Sunrun’s recent trading history suggests it frequently encounters resistance in the $20 to $24 zone, which could pose challenges for upward momentum in the short term. However, should RUN successfully breach the $24 mark, the technical outlook becomes decidedly brighter, signaling little resistance ahead and allowing for more aggressive investment strategies.

The solar sector operates within a complex dynamic shaped by macroeconomic factors and certain geopolitical currents, making it crucial for investors to remain cognizant of external influences. As inflation rates and overall economic conditions fluctuate, the market’s appetite for renewable energy could shift accordingly.

Strategic Implications for Investors

In a risk-off market environment, investments that counter prevailing trends become increasingly valuable. The recent uptick in solar stocks presents an intriguing opportunity for discerning investors. While both First Solar and Sunrun have laid the groundwork for potential upward movements, the uncertain nature of market conditions necessitates a cautious approach.

A disciplined strategy involves closely monitoring these stocks, particularly as the landscape evolves in the lead-up to the November elections. Investors should remain alert to any developments that may affect the broader renewable energy agenda, as political leadership will largely shape funding and regulatory frameworks influencing the sector’s future viability.

While solar stocks had experienced a disappointing year compared to the broader market, the recent resurgence offers a glimmer of hope. Armed with the right technical indicators, investors may find attractive opportunities within this sector. The convergence of political stability, market enthusiasm for renewable energy, and strong technical indicators positions solar companies as intriguing prospects that deserve closer scrutiny in these turbulent times.

As we traverse through unpredictable economic territory, maintaining an adaptable investment strategy encompassing the evolving landscape of solar stocks may yield rewarding outcomes in the long run. Investors should continue to assess the implications of market trends and political developments, positioning themselves to leverage potential gains in this revitalized sector.