The Hidden Potential of Deleted Stocks: Unveiling a Unique Investment Strategy

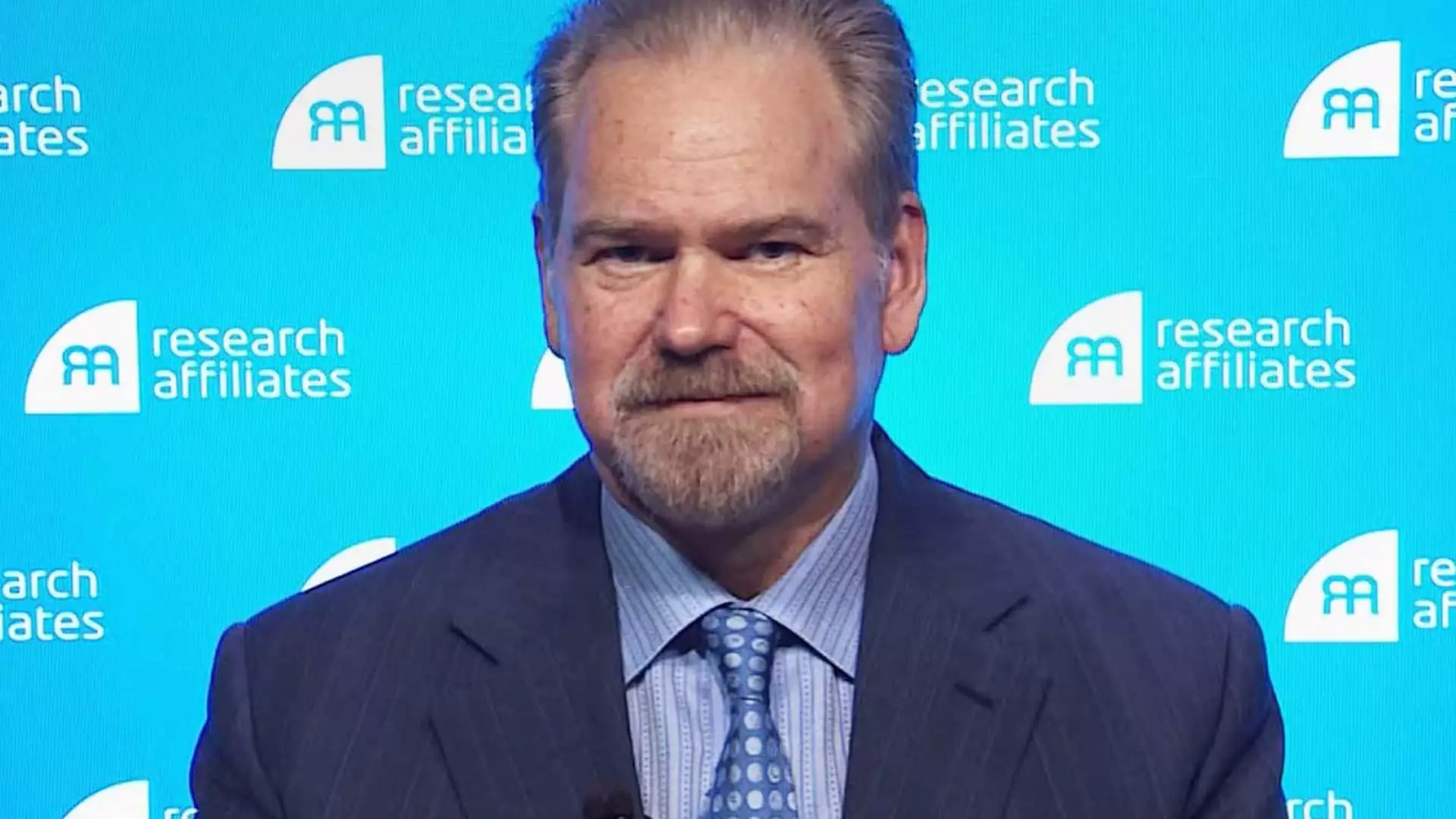

In a recent market development, American Airlines, Etsy, and Bio-Rad Laboratories have transitioned away from their positions in the S&P 500. This shift follows a period marked by significant underperformance, ultimately relegating these companies to smaller-cap indices. While some may view this demotion as a negative sign for the stocks and investors alike, Rob Arnott, founder of Research Affiliates, presents a counterintuitive perspective: such events may serve as precursors to a potential rally in the affected stocks.

Historically, stocks that fall out of prominent indices have been subjects of interest among investors looking for undervalued opportunities. Arnott has launched the Research Affiliates Deletions ETF (NIXT), which specifically targets companies that have been removed from the S&P 500 or the Russell 1000 over a five-year timeframe. The premise? These stocks may have hit rock bottom, and investors can benefit from the inevitable recovery when downward trends reverse.

Index funds represent a significant share of asset management in today’s investment landscape, particularly those tracking large-cap indices such as the S&P 500. The transition of stocks between indices can create ripples in the market, leading to billions of dollars in mechanical buying and selling. Arnott highlighted an essential point about this phenomenon: when a stock exits an index, it often indicates that it has been trading at lower valuations, yet this very characteristic could render such stocks ripe for resurgence.

Arnott’s premise relies on observing historical patterns, dating back to the 1980s when he first noted stocks’ tendency to rebound after being relegated. Following his observations, Arnott introduced strategies based on these tendencies, culminating in his investment approach and the recent establishment of the NIXT fund. This fund operates on a custom index model anchored in market capitalization, suggesting that despite the various complexities involved in index revisements, a systematic focus on value can yield preferable returns.

In analyzing the structure of the NIXT fund, it emerges as an intriguing combination of small-cap value investment strategy and the potential for significant upside. Arnott emphasizes how the fund steers clear of so-called “value traps,” where investors risk losing capital on stocks that appear cheap but lack potential for recovery. This meticulous selection process involves screening stocks based on profitability, debt coverage ratios, and other critical quality metrics.

One of the key insights from Arnott’s analysis is the historical performance of deleted stocks, which illustrates a tendency to outperform their peers. For instance, data shared by Arnott indicates that the custom index underlying the NIXT fund would have exceeded the performance of the Russell 2000 Value Total Return Index over various time frames. This compelling evidence suggests that stocks removed from larger indices often possess hidden potential waiting to be unlocked.

It’s essential to consider the dynamics of market sentiment when examining deleted stocks. These stocks are often characterized as illiquid, thinly traded entities. Under such conditions, large sell-offs—such as the 25% of total market capitalization being traded off—can inflict severe price impacts. However, this initial downturn paves the way for strong recoveries. Arnott asserts that the performance of deleted stocks should be measured from the effective date of index changes rather than mere announcements, as market behaviors can significantly shift during this interim period.

Investors utilizing Arnott’s strategy must recognize that while not every stock that leaves a large-cap index will succeed, the potential for profitable outcomes often overshadows the risk of losses. The portfolio’s overarching structure suggests that even a scenario where half of the stocks decline by 50% while the other half doubles can lead to overall gains, exemplifying the power of strategic stock selection.

Research Affiliates, managing assets totaling around $147 billion, has positioned itself at the forefront of innovative investment strategies. Arnott’s newly launched fund, backed by historical data and a nuanced understanding of market dynamics, presents a compelling case for investors seeking to capitalize on the performance of deleted stocks.

As traditional investment models face increased scrutiny and challenges, strategies like those proposed by Arnott not only provide alternative avenues for investment but also emphasize a deeper understanding of market behaviors and stock performance patterns. For astute investors, the transition of stocks from major indices could signal the dawn of a new era of opportunity, where undervalued players on the market stage emerge ready to reclaim their positions.