Rethinking S&P 500: The Shift Towards Value Investing

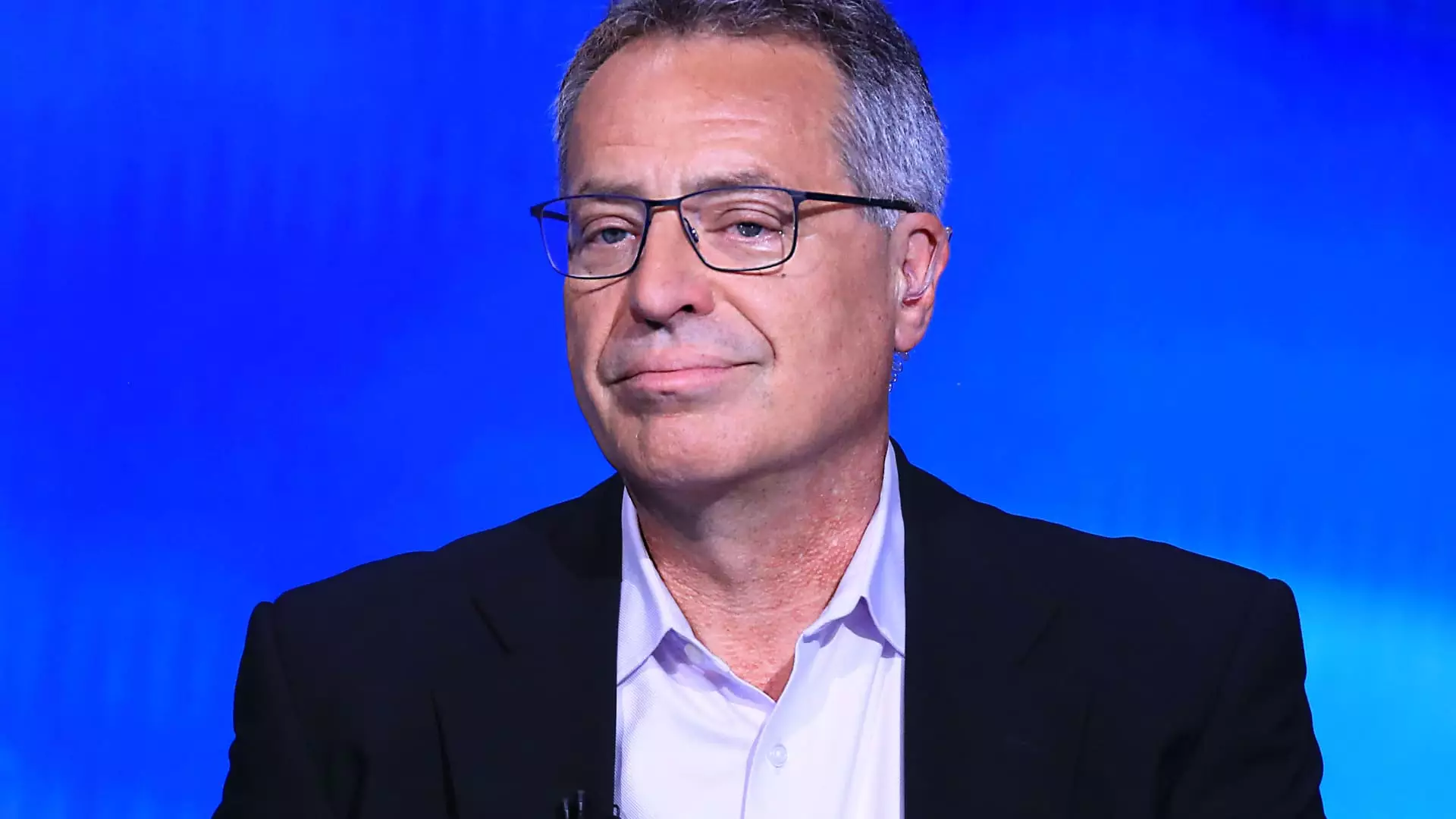

In recent discussions, veteran value investor Bill Nygren has raised important concerns regarding the current composition and diversification of the S&P 500 index. After four decades as a portfolio manager at Oakmark Funds, Nygren has observed a significant shift in the index, primarily driven by the overwhelming influence of the technology sector. The ascent of large-cap tech stocks such as Nvidia and Meta Platforms has been staggering, with the top 25 companies now representing nearly half of the index’s total value. This raises critical questions about the longstanding perception of the S&P 500 as a stable and diversified vehicle for equity investment.

Nygren warns that this concentration of high-performing tech stocks may deceptively lull investors into a false sense of security. With the index recently hitting record highs following a roughly 20% surge, primarily fuelled by a handful of tech giants, there is a growing fear that this reliance on a narrow segment of the market could signal fragility in the prevailing bull market.

The shifting landscape compels investors to scrutinize their strategies, especially those who traditionally leaned on the S&P 500 as a low-risk investment approach. An essential aspect Nygren highlights is the divergence in stock valuations within the market. Many investors are currently shunning value stocks, which presents an opportunity for those willing to dig deeper. By focusing instead on companies that are trading at attractive valuations and implementing aggressive buyback programs, savvy investors can potentially unlock value that the broader market overlooks.

Nygren’s investment strategy has pivoted towards identifying undervalued stocks that are actively managing their capital through buybacks. He emphasizes the merit in companies that take ownership of their equity value, independent of market trends or investor sentiment. This not only bolsters their stock prices but also demonstrates a proactive posture towards maintaining shareholder value.

One notable example from Nygren’s portfolio is Corebridge Financial, a relatively unknown entity that recently emerged from the AIG umbrella. Valued around $28 per share, Corebridge operates in the retirement services and life insurance sectors and has the potential to appreciate significantly. Nygren projects that the company might achieve a book value of $50 by the end of 2025, blossoming to four to five times its earnings in the process.

The attractiveness of Corebridge lies in its ability to repurchase an estimated 20% of its stock annually, effectively lifting its share price without necessitating external recognition of its value. Nygren’s belief in this stock exemplifies his commitment to identifying hidden gems within a market that often prioritizes the dramatics of mega-cap growth, thereby illuminating a path for discerning investors willing to eschew mainstream choices.

As Bill Nygren advocates for a shift in investment strategy, it becomes clear that a renewed focus on value investing amidst the dominance of the tech sector might be essential for investors looking to build a resilient portfolio. As the S&P 500 reveals its diminishing diversification, discerning opportunities outside high-flying tech stocks will not only provide safety but may also unearth substantial long-term gains in overlooked corners of the market. Embracing this change could foster a broadened understanding of contemporary investing, steering the focus from popular trends to enduring value.