The Shifting Landscape of Berkshire Hathaway’s Stake in Apple

Warren Buffett, the iconic investor synonymous with acumen and precision, has once again drawn attention through significant modifications to Berkshire Hathaway’s substantial investment in Apple Inc. Over the last four quarters, Berkshire has gradually reduced its apple holdings, which now stand at a staggering $69.9 billion as of the end of September. This consistent divestment, amounting to nearly a quarter of Buffett’s stake—approximately 300 million shares—leads to speculation about the strategies at play behind this move.

It’s crucial to note that since last year, Buffett’s stake has plummeted by 67.2%. This reduction raises eyebrows, particularly as Buffett’s history with Apple has been one of admiration. He began trimming his position in the fourth quarter of 2023 and accelerated the pace of sales significantly in the second quarter, when he unexpectedly divested nearly half of his investment. Such drastic actions from a seasoned investor warrant thorough examination.

The motivations behind Buffett’s decision to sell are complex and multifaceted. Analysts have suggested two primary factors: the stock’s high valuation and the necessity for diversified portfolio management to mitigate risks associated with concentration. Once, Apple’s stock represented an astonishing 50% of Berkshire Hathaway’s equity portfolio. The wisdom in reducing this exposure cannot be overstated, especially with market volatility in play.

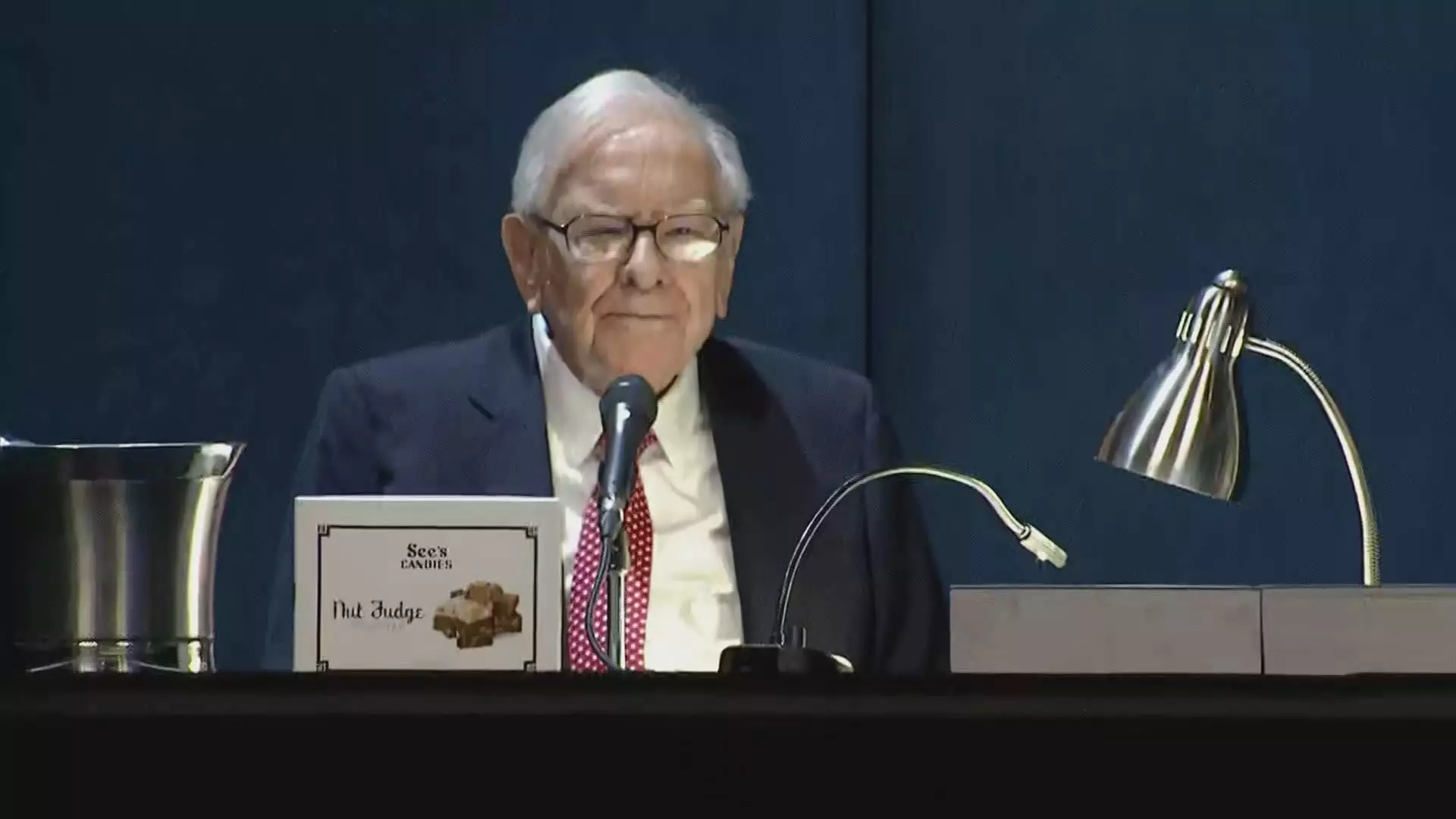

At the Berkshire Hathaway annual meeting in May, Buffett indicated potential tax implications as a motivator, hinting at the prospect of rising capital gains taxes. This foresight, typical of Buffett’s analytical style, seems plausible given the current fiscal landscape and government efforts to address burgeoning deficits. Nevertheless, the scale of his selling makes one wonder if there are deeper considerations at work.

From Caution to Commitment

Buffett’s relationship with technology investments has evolved dramatically, particularly with Apple. Historically, Buffett steered clear of tech companies, claiming they fell outside his circle of competence. However, the appeal of Apple—which boasts a fiercely loyal customer base and a robust ecosystem—prompted a shift in Buffett’s traditional investment philosophy. Once, he considered Apple the second-most important business after Berkshire’s insurance operations.

This recent selling spree also coincides with an increase in Berkshire’s cash reserves, which reached an unprecedented $325.2 billion in the third quarter. Despite having ample cash at their disposal, Berkshire abstained from buybacks entirely during this period. This could signal that Buffett may be positioning himself for other lucrative investment opportunities that align more closely with the company’s strategic vision.

As Apple shares have surged 16% this year, modestly trailing behind the S&P 500’s 20% increase, the questions around Berkshire’s management remain urgent. Buffett’s actions exemplify a broader theme in investment: the need to adapt to changing market conditions and to rethink entrenched beliefs. This situation serves as a reminder for investors that even the most revered figures in finance reassess their strategies in light of market dynamics—an essential lesson for anyone navigating the complexities of investment in today’s environment.