The Rising Cost of Climate Recklessness: How Wildfire Risks Are Devastating Municipal Bonds

In recent years, the destructive force of wildfires has evolved from an environmental concern into an alarming economic threat….

In recent years, the destructive force of wildfires has evolved from an environmental concern into an alarming economic threat….

Houston’s latest bond issuance reveals a city obsessed with expanding its airport system at a pace that might be…

In recent years, the energy infrastructure sector has witnessed an aggressive push towards innovative financing methods to offset soaring…

The recent stagnation and underperformance of municipal bonds, especially compared to other asset classes, should serve as a loud…

Utah’s largest public school system, Alpine School District, is embarking on a significant move to split into three autonomous…

For over a decade, the municipal bond market has lingered in a state of complacency, stagnating around a staggering…

North Carolina’s local government authorities have recently approved a staggering $505 million in bonds across three major projects, a…

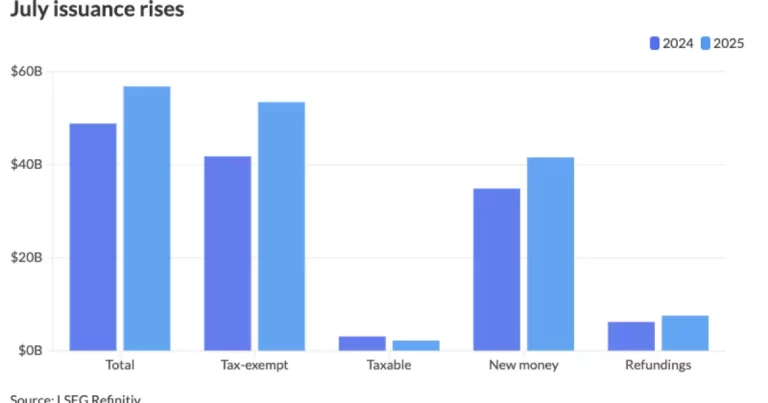

The recent surge in municipal bond issuance appears impressive at first glance, yet a closer, more critical look reveals…

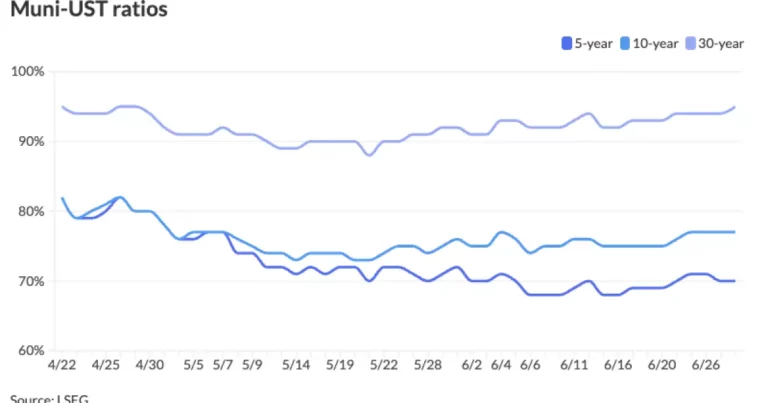

The municipal bond market, often praised for its stability and tax advantages, is currently exhibiting signs of fragility that…

Municipal bonds, long touted as safe havens for conservative investors, are showing signs of fragility that demand more sober…