Current Trends in Build America Bonds: Market Challenges and Future Outlook

Build America Bonds (BABs) were introduced during the 2009 economic downturn as a way for state and local governments to finance infrastructure projects at reduced costs. These taxable municipal bonds provided issuers with a federal subsidy to offset borrowing costs, allowing them to engage in significant public projects. However, as market conditions fluctuate, especially with rising interest rates and increasing ratios, there are growing concerns regarding the viability of BABs. A recent slowdown in BAB redemptions has sparked conversations among investors and issuers about the future of these bonds and the strategic decision-making involved in whether to call back outstanding BABs.

Recent data reveals a gradual slowdown in the redemption of Build America Bonds, particularly in 2024, where around $14.9 billion in BABs have been called back, with an additional $938.3 million awaiting redemption. Notably, a total of 39 issuers have launched deals for refunding their existing BABs. Analysts estimate that a staggering $30 billion of outstanding BABs could potentially be eligible for extraordinary redemption provisions (ERPs), especially following a favorable court ruling that clarified the legal framework for issuers. Nonetheless, the financial feasibility of refunding BABs remains crucial, with economic conditions playing a significant role in decision-making.

As Nick Venditti from Allspring has pointed out, refunding BABs only makes economic sense when interest rates are markedly lower than they are in the current environment. With the 10-year U.S. Treasury yielding 4.27%, the recent municipal bond selloffs have put pressure on yields, greatly diminishing the savings expected from refunding activities traditionally enjoyed in prior years.

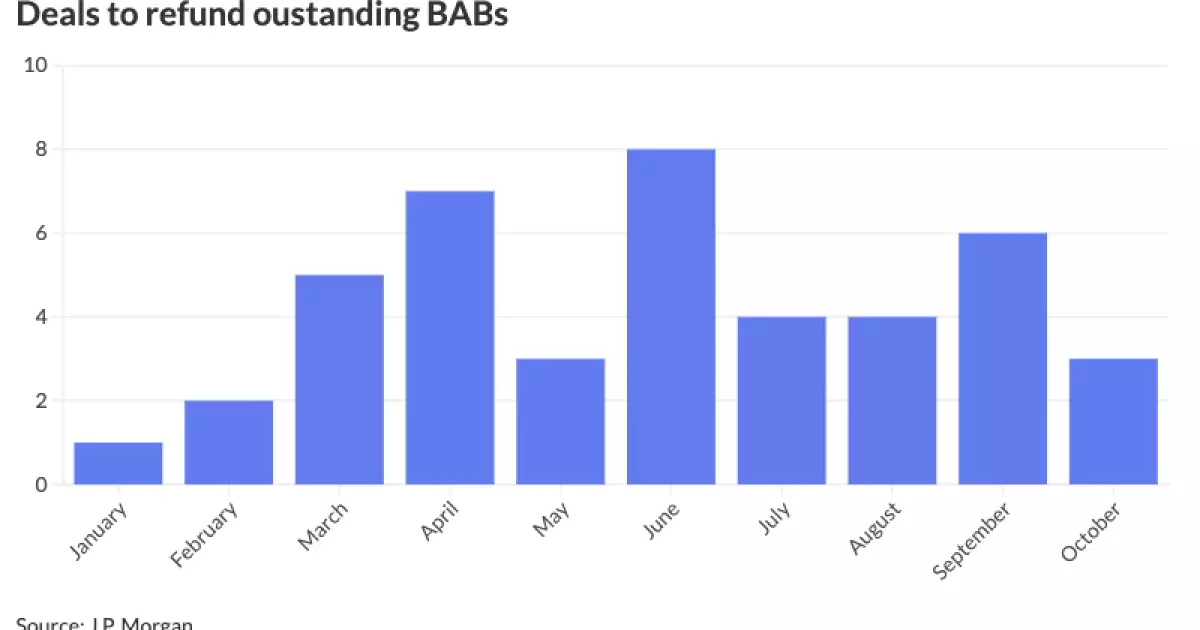

The beginning of 2024 showcased a stark contrast in BAB market activity, with a slow start in the first quarter followed by a surge of activity in the second quarter. However, a subsequent decline in the third quarter indicated a reticence among issuers to refinance. During June, the highest volume of refunding deals materialized, followed by notable activity in April and moderate movements in other months. This pattern suggests that while there remains a keen interest in refinancing, current market volatility has played a significant part in stifling further growth.

James Pruskowski of 16Rock Asset Management emphasizes that the increasing interest rates have curtailed the enthusiasm for issuing bonds, leading to a marked reduction in the urgency to refinance. Furthermore, there appears to be a broader trend of both investors and issuers reconciling concerns raised earlier in the year regarding extraordinary redemption provisions in bond agreements. This newfound clarity may contribute to a more balanced perspective on future bond dealings.

Market volatility has had a tangible impact on refunding activities, as evidenced by the Ohio Water Development Authority’s decision to withdraw a $102 million refunding deal intended for the Fresh Water Revolving Fund. Due to uncertain net present value (NPV) savings, officials decided to postpone the transaction until more favorable market conditions emerge. It underscores a critical sentiment among bond issuers: that current market conditions must stabilize before issuing new debt amidst fluctuating interest rates.

Despite existing challenges, many issuers have not been deterred from their plans to refinance BABs. For example, Baltimore County successfully managed a $177 million refunding deal recently, signaling an optimistic undertone within some sectors of the market. According to Ballard Spahr’s Teri Guarnaccia, the absence of bondholder disputes during this process points to a steady approach taken towards BABs, even amid turbulent times.

The prevailing investor sentiment surrounding BABs remains cautious. The inherent risks associated with callable bonds, coupled with the overshadowing threat of interest rate hikes, contribute to their current unattractiveness for many institutional investors. Venditti highlighted the notion that BABs have become somewhat “uninvestable” due to an unpredictable market environment, fostering hesitance among potential investors.

As the situation continues to evolve, it is plausible that legislative changes could reinstate confidence in the BAB structure. To re-engage a broader range of investors, assurance regarding the call structure must be fortified. Until then, issuers will need to navigate a challenging landscape where the dynamics of interest rates and investor sentiment dictate their strategies moving forward.

While the Build America Bond market faces significant challenges linked to rising rates and changing economic conditions, the decision-making process regarding refundings remains a delicate balance of cost-benefit analysis, market timing, and perception management among investors.