Current Trends in the Municipal Bond Market: An Analysis

In the evolving landscape of the financial markets, the municipal bond market is demonstrating noteworthy resilience amidst broader economic fluctuations. Recent observations from the trading session reveal a slightly softer tone for municipal bonds, yet they continue to outperform U.S. Treasuries. This article delves into the intricacies of the municipal bond market, shedding light on current trends, investor behavior, and the implications of ongoing economic dynamics.

On a recent Wednesday, municipal bonds showed a modest pullback but exhibited greater strength compared to the U.S. Treasury market, which witnessed larger declines, particularly in longer maturities. This performance can be attributed to a combination of factors, including strategic investor interest in new issues and the abundance of liquidity in the market. The municipal-to-Treasury yield ratios for various terms suggested a cautious yet optimistic positioning among investors. As the market adjusted, expectations surrounding potential interest rate movements remained a prevalent theme.

The recent influx of new municipal bond issues has been met with robust demand from investors. According to assertions from industry experts, such as Julio Bonilla of Schroders, there is a palpable appetite for new issues, which has continued to attract cash from sidelined investors. With over $6 trillion in money market funds and nearly $2.5 trillion in certificates of deposits, the market is saturated with liquidity. As interest rates hover around historic lows, investors are increasingly inclined to explore longer-duration bonds as a means of accessing yield.

Notably, the Columbia University $500 million bond sale exemplifies this trend, featuring a carefully structured offering that drew investor interest amid a backdrop of slightly softened pricing. The tight spreads observed in this deal reflect investor confidence despite the prevailing market uncertainties. The performance of such issues underscores the importance of liquidity management and the strategic positioning of cash in the municipal bond arena.

As the Federal Reserve signals potential rate cuts, investors are reassessing their strategies in line with changing economic conditions. The inclination to shift from short-term instruments to longer-duration debt is indicative of a proactive approach among market participants. Industry experts indicate that incremental rate cuts could further catalyze this trend, as investors seek to optimize returns in a landscape characterized by dwindling yields.

Furthermore, the relationship between equity markets and the municipal bond sector has become increasingly intertwined. The high valuations within the equity sphere prompt some investors to diversify their portfolios by allocating capital towards municipal bonds, which, on a tax-adjusted basis, remain attractive. This intermarket movement is vital in shaping the overall demand dynamics.

Fund Flows and Trading Trends

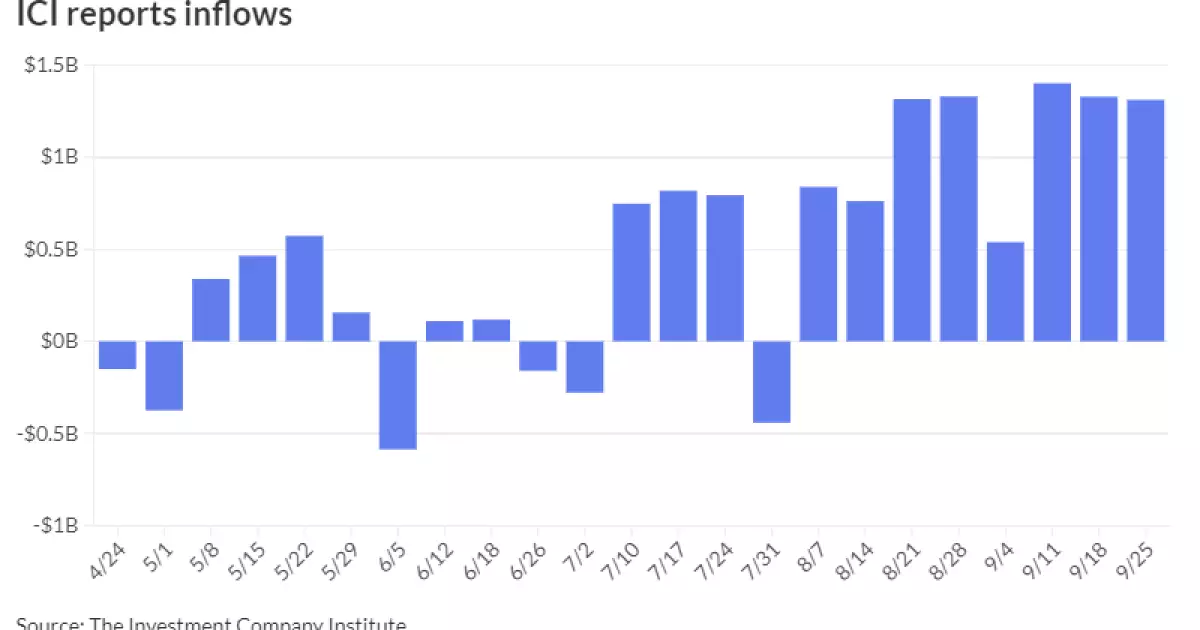

The Investment Company Institute (ICI) recently reported sustained inflows into municipal bond mutual funds, with over $1.3 billion flowing into these vehicles. Such inflows are indicative of growing investor confidence in the sector, and they contribute to a well-supported market environment. Additionally, exchange-traded funds (ETFs) have seen a marked increase in inflows, reflecting a broader trend towards passive investment strategies that capitalize on market momentum.

It’s also worth noting that trading activity remains robust, even as underwriters increasingly rely on fund buying to bolster market stability. This reliance on fund flows underscores the importance of mutual funds in mitigating trading volatility and enhancing overall market liquidity.

As we look ahead, analysts are cautiously optimistic about the trajectory of the municipal bond market. There are forecasts suggesting potential year-end surges in refunding activity, which could lead to record issuance levels in 2024. The prevailing demand for municipal securities is bolstered by the retail investor class, whose participation is critical in sustaining market momentum.

While the short-term outlook remains influenced by impending interest rate decisions and market reactions, long-term trends may see a sustained demand for municipal bonds as liquidity remains abundant and investors search for yield. The interplay between investor sentiment, economic indicators, and market developments will ultimately shape the contours of the municipal bond market in the coming months.

The municipal bond market is currently navigating a complex landscape, marked by shifting investor strategies, significant liquidity, and evolving economic conditions. As municipalities continue to issue bonds, investor demand appears robust, underpinned by a nuanced understanding of market dynamics. This sector may very well represent a crucial avenue for investors seeking stability and yield, reinforcing its integral role within the broader financial ecosystem. The interplay between various market forces and investor behavior will be key in determining the future course of municipal bond markets.