Geopolitical Pressures and Market Dynamics: Insights into Municipal Bonds

As the municipal bond market navigates a landscape rife with geopolitical uncertainties and fluctuating economic indicators, recent developments reveal both the resilience and vulnerabilities within this sector. The interplay between U.S. Treasuries, macroeconomic data, and investor sentiment contributes to a complex environment, reflecting on how municipal bonds continue to be a favored choice among investors despite external pressures.

The landscape for municipal bonds has recently shown signs of pressure as broader economic uncertainties loomed. The latest trading week witnessed losses in U.S. Treasury securities, which typically serve as a benchmark for pricing municipal bonds. As geopolitical tensions brew alongside mixed macroeconomic indicators, municipal bonds have not been exempt from the rippling effects of fiscal anxiety. Notably, inflation figures and labor data are drawing close scrutiny as investors position themselves ahead of key economic reports.

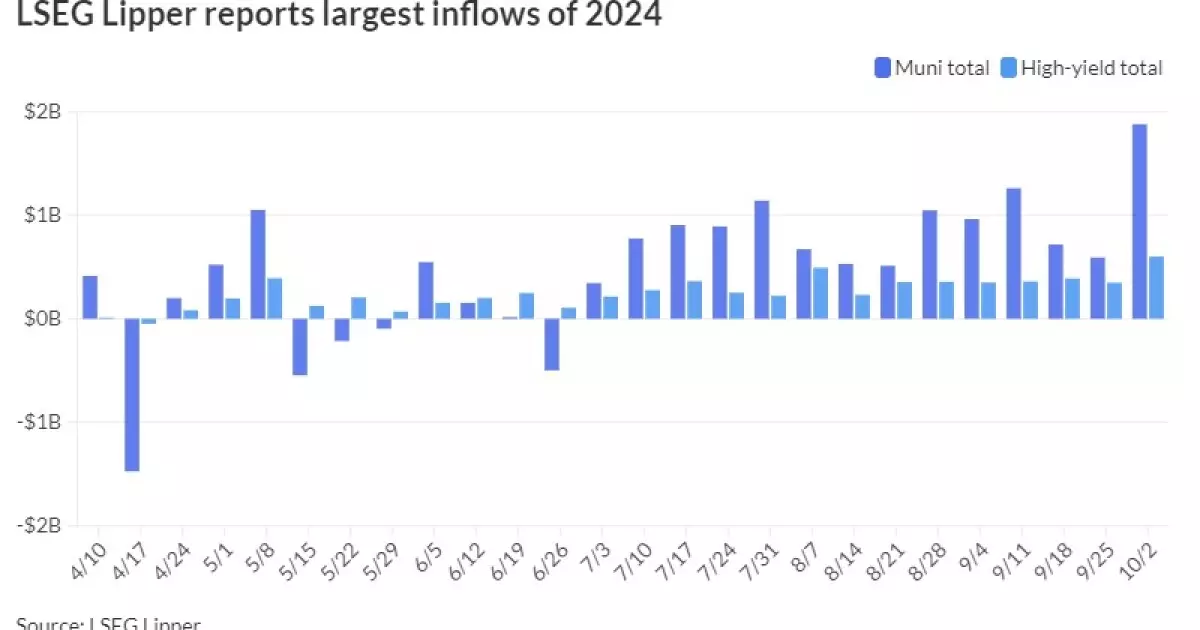

Despite these challenges, investor appetite for municipal bonds appears robust, marking the 14th consecutive week of inflows into municipal bond mutual funds. This consistent inflow of approximately $1.9 billion indicates a sustained belief in the stability offered by tax-exempt debt, especially as the market adjusts to new economic realities. According to LSEG data, a significant rise in weekly inflows signals a strong support base among investors seeking refuge from market volatility elsewhere.

The unexpected uptick in fund inflows draws attention to the underlying reasons behind the allure of municipal bonds, particularly in this period of economic flux. High-yield municipal bond funds experienced inflows of $602.3 million, representing a pronounced shift in investor strategy as they hedge against potential economic downturns—especially as interest rates rise. The strategic insight shared by J.P. Morgan regarding the timing of reinvestment capital reflects the investors’ inclination to seize favorable conditions before potential downturns in the market.

Moreover, despite a recorded increase in bond issuance of 35.2% up to September, the municipal bond market has maintained an attraction for yields that often outperform U.S. Treasuries. Notably, oversubscriptions in new bond offerings and a trend toward lower yields in the primary markets further solidify this tilt. The convincing demand echoes a sentiment that even amidst economic uncertainty, the municipal bond market remains a solid investment choice.

Interestingly, while municipal bonds took slight yield cuts in certain areas on Thursday, they continued to outperform their Treasury counterparts. The alignments across yield ratios—such as the two-year municipal-to-Treasury ratio standing at 61%—indicate that investors are not shying away from longer-duration municipal bonds, a typically risk-averse choice in times of high interest rates.

Recent competitive offerings, like the pricing of water system revenue bonds from San Antonio, highlight the intricacies of the municipal market. Debt offerings at specified rates send clearer signals about investor expectations moving forward, hinting at optimism in municipalities’ financial responsibilities despite broader economic challenges.

A pivotal factor influencing municipal bonds is the labor market, particularly as attention shifts towards Friday’s employment report. Recent ADP employment data hinted at a stronger-than-expected growth in private payrolls, suggesting a potential upside risk for the forthcoming Nonfarm Payrolls report. This data may complicate the narrative surrounding potential Federal Reserve rate adjustments, as emerging labor strength could precipitate tighter monetary policy.

Economic observations surrounding the labor market indicate a discrepancy between forecasts and actual government data. J.P. Morgan’s analysis that the average difference between ADP projections and actual Bureau of Labor Statistics reports has historically been sizable presents a compelling argument. If discrepancies continue, it could lead to reevaluations of Federal Reserve strategies, directly impacting the municipal bond market’s outlook.

The municipal bond market is currently reflective of broader economic complexities characterized by geopolitical uncertainties and evolving macroeconomic landscapes. While the inflows into municipal bonds portray a staunch investor confidence, analysts must remain watchful of macroeconomic indicators—especially those derived from labor market data—as they could dramatically reshape expectations and influence future bond performance.

The lessons learned from this period will dictate how market participants position themselves moving forward. A careful watch over economic signals will be essential for navigating the intricate balance of risk and opportunity in this favored sector of finance.