Market Outlook: Navigating Economic Uncertainties

In a landscape colored by potential political shifts and economic adjustments, the financial markets are poised for moments of volatility. As stakeholders prepare for crucial events, including impending election outcomes and pivotal Federal Open Market Committee (FOMC) meetings, many are exercising caution. This period of hesitance is reflected in the stability observed in municipal bond markets, which remained unchanged as participants awaited clarity. The intersection of political dynamics and monetary policy is critical, as upcoming decisions will have lasting implications on various economic fronts.

Impact of Political Outcomes on Financial Markets

The interplay between politics and finance cannot be understated, especially when considering how election results could influence economic environments. Analysts are closely monitoring the electoral landscape, particularly with contrasting scenarios such as a Trump or Kamala Harris victory on the horizon. A Trump victory is poised to evoke concerns about inflationary pressures, suggesting that markets might brace for a more turbulent financial environment driven by aggressive trade policies. Conversely, a Harris administration is expected to align more closely with existing policies, likely stabilizing expectations in the municipal bond market. Erik Weisman, chief economist at MFS Investment Management, aptly characterized it by stating that Trump’s presidency could herald an inflationary landscape, while Harris’s leadership might maintain the status quo.

Market sentiment, quantified by political “betting markets,” suggests a strong possibility of Republican consolidation, which could impact fiscal approaches such as corporate taxes. According to J.P. Morgan strategists, a ‘red sweep’ could complicate tax policies, potentially signaling more challenging times for tax-exempt municipal markets. With an estimated 48% probability suggesting a Republican victory, the implications for tax strategies become a focal point of financial analysis.

As the looming decisions draw near, the bond market’s reactions become a matter of keen intrigue. Historical perspectives reveal that fixed-income environments have, for the most part, been predominantly influenced by Federal Reserve policies rather than the political landscape. However, the prospect of Trump steering trade negotiations could signify a shift in this dynamic. Higher tariffs, as outlined by various analysts, might lead to escalated inflation rates that complicate the Federal Reserve’s maneuvering room for rate cuts.

Andrzej Skiba of RBC Global Asset Management emphasizes the potential for an uptick in tariffs to create a chokehold on inflationary control, thereby affecting the Fed’s rate decisions. The implications of a 1% inflation rise invoked by new tariffs could introduce a challenging climate for fixed-income securities, raising difficult questions about monetary policy’s effectiveness in maintaining economic stability.

Investment strategies in the bond market are closely tied to perceptions of government fiscal policy, particularly in light of the growing national debt. Investors are cognizant that irrespective of electoral outcomes, challenges stemming from increasing deficits will shape governmental financial strategies. As discussed by Bryce Doty, senior portfolio manager, the looming national debt raises alarms, particularly as interest expenses continue to eclipse defense expenditures.

While speculation around interest rates remains a focal point, market experts are divided on the true impact of political outcomes on bond demand. Some, like Doty, envision a more productive growth trajectory under Trump’s policies, one that could potentially nurture higher tax revenues despite initial inflationary concerns. In contrast, J.P. Morgan’s insights suggest that a unified Democratic government could lead to tax increases, opening avenues for positive adjustments within tax-exempt markets.

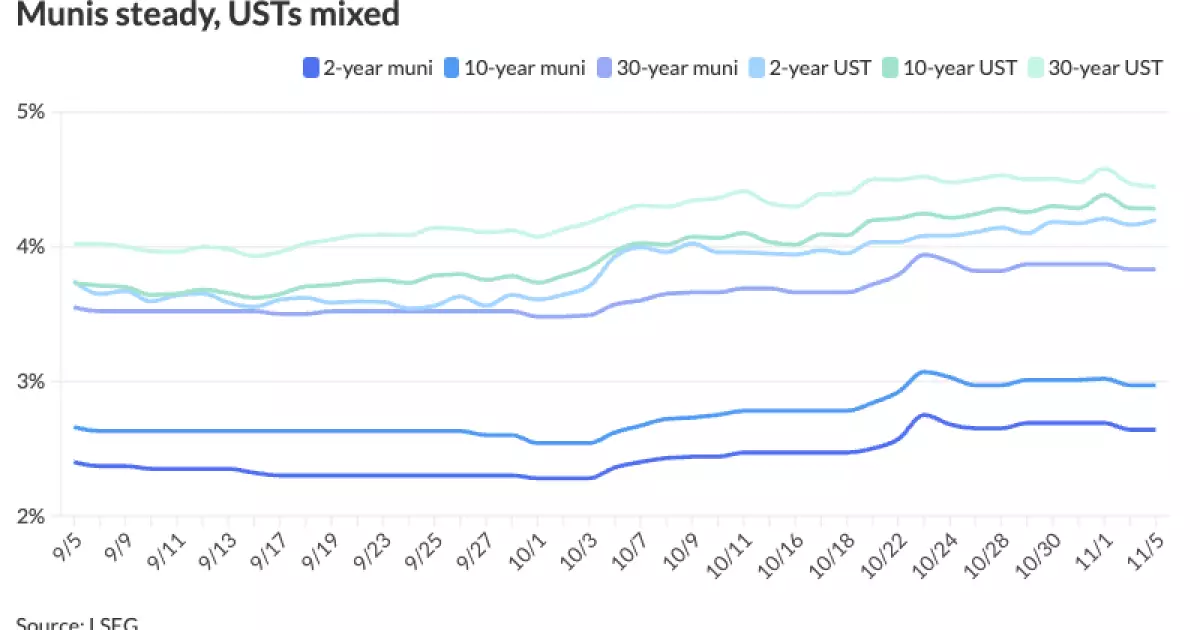

Despite the overarching uncertainties, the municipal bond market has demonstrated resilience in light of demanding conditions. According to recent data, prevailing yields on various municipal bonds like the 10-year and 30-year remained steady, illustrating a stabilization in bonds amid the backdrop of impending political developments. The constancy in these yields reflects a market attempting to reconcile potential outcomes with current valuations.

Investor behavior is ultimately reliant on the nuances of economic data as they emerge. Upcoming pricing activities, especially regarding municipal bonds by governmental authorities across states, are poised to contribute to the overall market dynamics, serving as indicators of investor confidence and demand in the face of evolving economic landscapes.

As stakeholders brace for the upcoming wave of political and economic shifts, the balance between expectation and reality will be crucial in navigating financial landscapes. With elections on the horizon and Federal Reserve decisions looming, the blend of uncertainty and potential market movement could create a confluence of opportunities and risks within the municipal bond market. The days ahead will not only test investor foresight but also establish the trajectory of fiscal policy and its broader economic implications.