Recent Trends in Municipal Bonds and Market Dynamics

After a series of four consecutive trading days marked by rising yields, the municipal bond market experienced a noteworthy rebound on Thursday. Municipal yields retraced downwards by as much as seven basis points based on different maturities, signaling a shift in investor sentiment. This correction coincided with a slight decline in U.S. Treasury yields, which fell between one and five basis points across various terms. These movements in the bond market indicate a possible stabilization in municipal bonds after a volatile period, highlighting the complex interrelationships within fixed-income securities as both municipal and Treasury yields decreased in tandem.

However, while the immediate scenario appears positive, nuanced analysis reveals an ongoing struggle within the municipal market. Fluctuations in the Muni-UST ratios displayed little variation this Thursday, with the two-year ratio recorded at 66%, essentially echoing concerns about relative valuations within this market compared to U.S. Treasuries. A significant drop in ratios typically suggests diminishing demand for municipal bonds, thereby requiring a closer examination of market dynamics to predict potential future movements.

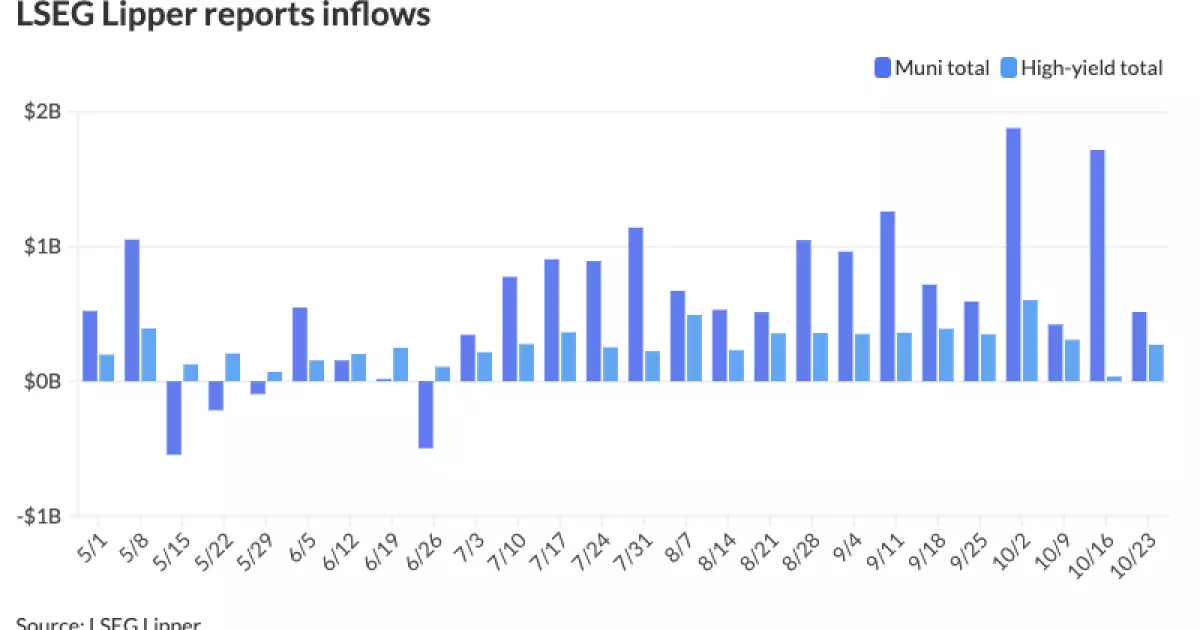

In another encouraging development, inflows into municipal bond mutual funds remained robust, as reported by LSEG Lipper. Investors infused $514.7 million in the week ending Wednesday, marking the seventeenth consecutive week of positive inflows. In contrast, the previous week had seen much higher inflows at $1.718 billion, prompting market analysts to inquire whether recent returns have incentivized this ongoing strategy to capitalize on perceived value in the municipal space. Particularly impressive was the surge in high-yield fund inflows, which ballooned to $271.8 million from the mere $36.2 million the week before.

Despite a dip in October returns—1.88% losses compared to positive yields in preceding months—investors seem unfazed, perhaps driven by year-to-date performance figures. The average annual return has been adjusted to a modest 0.37%. Sheila May, director of municipal bond research at GW&K Investment Management, outlined a tempered yet optimistic outlook, emphasizing that while recent economic reports have cast doubt on the Federal Reserve’s potential for continued interest rate cuts, the overall environment remains conducive for investing in municipal bonds.

The underlying fundamentals of the municipal bond market continue to exhibit resilience, with credit upgrades outpacing downgrades by a staggering 3.5 times this year. This robust credit performance stands in stark contrast to technical factors that appear less favorable, as noted by analysts at Principal Asset Management in their investigations into current market conditions. With total bond issuance reaching $418.451 billion year-to-date, an impressive 41.1% increase from last year, the reasons behind this surge point toward market fundamentals—the moderation of inflation, easing interest rates, and a slowdown in federal aid—all pushing municipalities towards the bond market for financial sustainability.

Analysts such as Matt Fabian from Municipal Market Analytics have spotlighted the increase in infrastructure-related issuance, signifying not just a temporary upsurge tied to a pre-election cadence but rather a persistent need driven by substantial deferred maintenance challenges in essential services. Estimates suggest a backlog of maintenance needs of approximately $1.2 trillion regarding water utilities, alongside another estimated $1 trillion associated with higher education infrastructure. These figures elucidate why municipalities are not just selling bonds opportunistically but are engaging in strategic financing to tackle persistent challenges.

While some analysts foresee a slowdown in issuance following early November, early data indicates continued interest from investors, particularly as many issues are scheduled to finalize before the holiday season. The recent surge in issuance—often surpassing $10 billion per week—has demonstrated market capacity to absorb significant supply without adverse effects. Both Timlin and Fabian have indicated that current market conditions present a rare opportunity for discerning investors to target bonds presenting attractive income spreads amid a favorable interest rate environment.

However, concerns linger regarding market conditions, exacerbated by election-related uncertainties and other economic dynamics that could destabilize accrued gains. Municipal bonds may face further “cheapening” in response to substantial net supply influx; therefore, a detailed watch on the leading indicators and financial reports will be crucial for investors navigating this complex landscape.

As the municipal bond market evolves, investors must stay alert to the shifting tides influenced by economic performance, supply changes, and strategic issuance. Balancing the search for yield among a multifaceted backdrop of market dynamics will remain paramount for investors seeking to capitalize on future growth in the municipal sector.