The State of the Municipal Bond Market: A Comprehensive Overview

The municipal bond market has demonstrated a remarkable resilience in recent times, maintaining a steady course while navigating multifaceted economic currents. As we analyze the latest developments, it is crucial to understand the nuances shaping this vital segment of the financial landscape. This article delves into the recent performance of municipal bonds, the driving factors behind their attractiveness amidst fluctuating treasury yields, and the continued inflow of capital from investors.

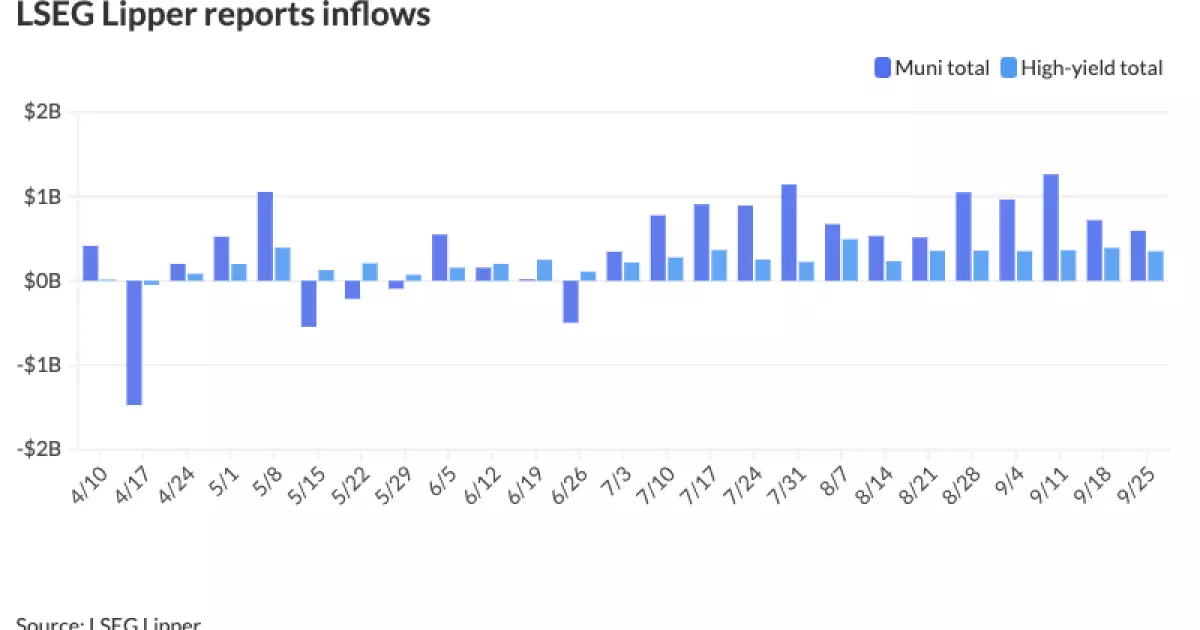

Recent observations indicate that municipal bonds have been relatively stable, unaffected by the fluctuations in the U.S. Treasury market. This detachment has become evident as municipal bond mutual funds recorded their 13th consecutive week of inflows. High-yield municipal bonds, in particular, have attracted significant investor interest, signaling a preference for the stability and yields these instruments offer.

A key metric to consider is the muni-to-Treasury ratio, which provides insights into how municipal bonds are performing relative to their Treasury counterparts. As of Thursday, this ratio showed consistency, with the two-year, three-year, and five-year munis hovering around 64% to 66% of their U.S. Treasury equivalents, and longer-term bonds following suit with a 30-year ratio around 85%. Such figures indicate that more investors are leaning towards municipal bonds, appreciating their tax-exempt status and the relative yield benefits they offer amid changing economic conditions.

Despite high issuance volumes totaling approximately $40 billion for the month, pressure for rising municipal rates appears absent, as noted by Kim Olsan, a senior fixed income portfolio manager at NewSquare Capital. This assertion highlights the current balance between supply and demand. With daily “bids wanted” decreasing by 15% in September compared to the year’s average, we see a softening in immediate demand against a backdrop of substantial issuance.

The role of municipal bond mutual funds cannot be overstated, with a collective inflow of $8.8 billion recorded this quarter alone. This influx underscores a sustained appetite for municipal investments, particularly in the high-yield segment, which has shown resilience with inflows surpassing previous weeks. The historical context reveals that the current year has seen $20 billion in high-yield municipal issuance to date, reflecting a return to normalization after a period of depressed levels.

Investment Strategies and Yield Opportunities

For investors, the current climate presents lucrative yield opportunities, especially for those in higher tax brackets. Intermediate AA-rated bonds are trading at around 2.75%, translating to taxable equivalent yields nearing 4.50%. Long-dated AA-rated securities with 5% coupons are offering similar attractiveness, characterized by yields around 3.60% with TEYs of 6.00%. These metrics highlight the significant advantages of holding municipal bonds, particularly in light of tax implications.

Moreover, larger issuances, particularly from well-rated entities like the Texas Water Development Board and Aldine Independent School District, have introduced varied maturities and coupon structures, further enhancing market liquidity. Such offerings not only provide immediate returns but also the potential for future capital gains as interest rates fluctuate.

Outlook Amidst Changing Economic Conditions

As we look ahead, some analysts predict that the upcoming month could witness heightened supply pressures, especially with impending elections. The anticipation of “outsized” supply could influence yield movements; however, it is expected that such changes could be contained in the near term. This cautious outlook suggests that while investors might brace for some fluctuations, the underlying demand for municipal securities should remain strong.

The state of the municipal bond market points towards a continued trend of stability and attractiveness for investors seeking safer returns in uncertain economic times. Despite potential upticks in supply, the solid metrics of demand through mutual fund inflows, along with favorable yield structures, offer a compelling case for municipal bonds.

The municipal bond market is weathering complex economic conditions with an impressive display of stability. Its relative immunity to the turbulence of the broader treasury market, coupled with a sustained flow of investment capital, makes it a vital area of interest for both individual and institutional investors. The strategic positioning in this market, alongside an astute understanding of yield potential and tax benefits, will continue to shape investment decisions in the near future.