The Surge in Municipal Bond Issuance: Trends and Implications for 2024

In recent months, the municipal bond market has experienced a robust wave of issuance, largely driven by the convergence of several economic and governmental factors. State and local governments, fueled by urgent capital needs and diminishing federal assistance, have accelerated their entry into the bond market. As economic conditions shift, this flurry of activity suggests a significant trend that warrants closer examination, particularly with the 2024 forecast now poised for upward revision.

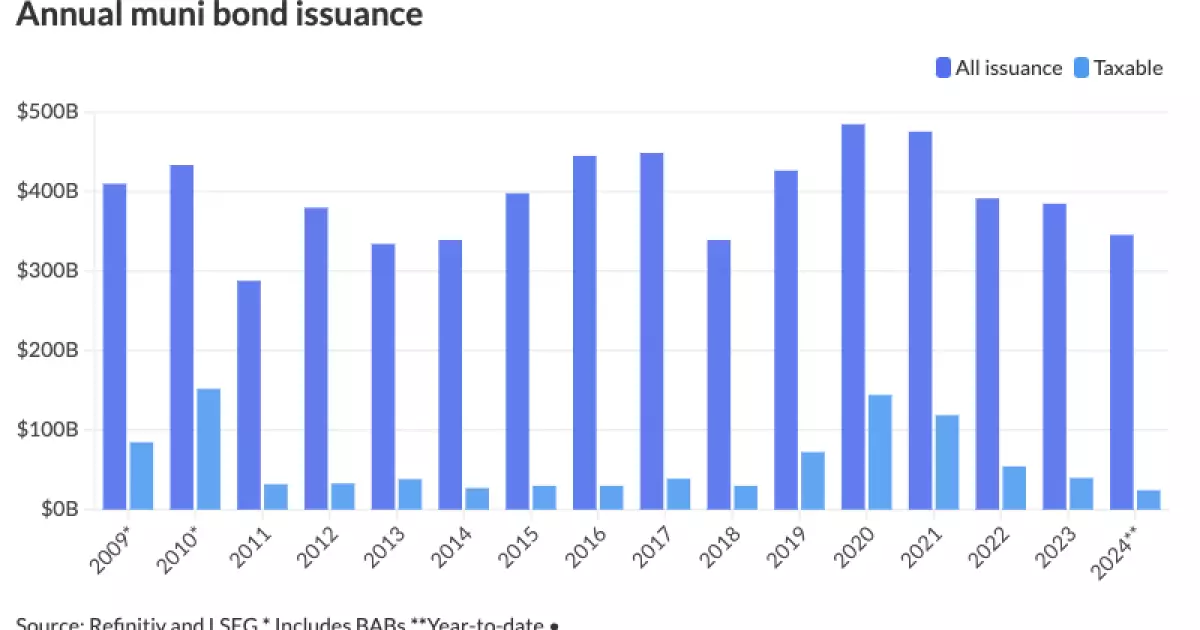

Historically, the municipal bond market has seen its fair share of highs and lows. The years 2020 and 2021 set the bar high with issuance reaching staggering levels of approximately $484 billion and $483 billion respectively. However, issuances drastically dipped in the subsequent years, with volumes falling below $400 billion in both 2022 and 2023. As of the present moment, 2024 seems to be poised to not only regain this ground but possibly exceed previous all-time highs. Currently, estimates point towards a total issuance that could reach between $475 billion and $500 billion, reflecting a crucial rebound in market activity.

Multiple factors are encouraging this resurgence in municipal bond issuance. The renewed economic vigor—unexpectedly strong growth figures—has been a key driver for many strategists who are now adjusting their forecasts. For instance, HilltopSecurities recently raised its issuance prediction from $420 billion to $480 billion. Similarly, the expectation that this year’s issuance could mirror patterns seen in 2016 further supports these bullish trends. The influx of capital for essential infrastructure projects and important community services compels governments to expedite their capital market entries, aiming to leverage favorable conditions while they exist.

The market dynamics surrounding these issuances are noteworthy as they showcase an evolving behavior among market participants. Major deals are increasingly clustered together; recent weeks have seen influential issuances from entities such as Washington, D.C., and the New York City Transitional Finance Authority. Such large offerings necessitate careful underwriting and pricing strategies to ensure satisfactory reception by investors. Bryan Derdenger, Managing Director at Baird, emphasized that having several mega deals occurring simultaneously offers unique characteristics that could entice various factions within the investment community.

Moreover, the current landscape is marked by strategic timing. With significant economic indicators such as the Consumer Price Index and Producer Price Index looming on the horizon, issuers seem keen to finalize their offerings. Alice Cheng, a credit strategist, points out that many issuers are motivated to complete their transactions ahead of anticipated Federal Reserve meetings, which can often lead to volatility in the financial markets.

The implications of this surge in issuance extend beyond immediate borrowing needs. The recent uptick has notably affected investor behavior and market liquidity. It’s essential to consider how the participation of buyers might change as a direct response to fluctuations in issuance. When issuance peaks, it tends to lead to a temporary dip in demand, as buyers may adopt a more cautious stance in anticipation of potential price corrections or shifts in interest rate policies.

Past electoral cycles have shown a definitive trend where issuance tends to be concentrated in the months leading up to an election, with participants aiming to navigate potential uncertainties. The historical data indicates that this pattern often forces a “front-loading” of issuance, creating an early rush that is typically followed by a significant taper off as the election nears. Derdenger highlights this behavior by pointing out that issuance could wane in late October as market participants reassess their strategies as November approaches.

As the municipal bond market navigates through this phase of heightened activity, the horizon for 2024 appears promising. With several fundamental factors converging—strong economic forecasts, the desire to front-load issuances before potential electoral disturbances, and the presence of significant infrastructure funding needs—the environment is primed for an exciting year. However, as always, the potential for external factors, such as unexpected economic reports or shifts in Federal Reserve policy, looms large. Market participants will need to remain vigilant and responsive, ensuring that they are well-positioned to adapt to whatever changes may arise in the ever-dynamic landscape of municipal finance.